Your Trusted

Buyers Advocacy Partner in Sydney

At SM Sydney Real Estate, we specialize in buyers advocacy and are here to simplify the property buying journey for you.

Send contact Request

Comprehensive Property Search

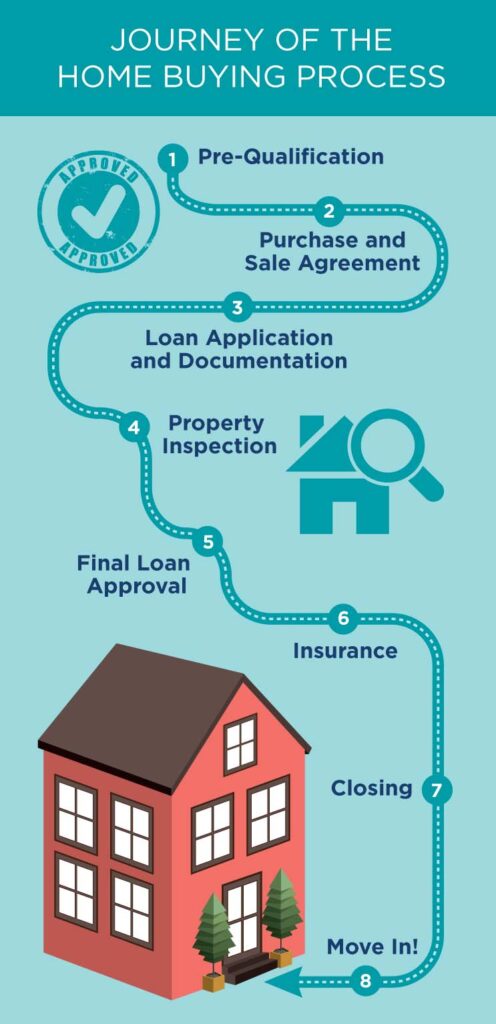

Are you looking to buy a property in Sydney but find the process overwhelming and time-consuming? Look no further. At SM Sydney Real Estate, we specialize in buyers advocacy and are here to simplify the property buying journey for you. With our extensive knowledge, experience, and network in the Sydney real estate market, we offer expert guidance and personalized support to help you make informed decisions and secure the best possible property deals.

Finding the perfect property can be a time-consuming process. Our team takes the hassle out of property hunting by conducting thorough searches on your behalf. We use our expertise and industry connections to identify properties that match your criteria, saving you time and effort.

15+

Years In Business

1.5k

Happy Clients

2.5k

Properties Dealed

150+

Agents Across Country

Our Services

Why Choose SM Sydney Real Estate?

Expertise in the Sydney Market

As a leading buyers advocacy firm in Sydney, we have in-depth knowledge of the local market dynamics, property trends, and emerging opportunities.

Personalized Approach

We understand that every buyer is unique, with specific preferences, budgets, and goals. That's why we take the time to listen to your requirements, understand your aspirations, and tailor our services accordingly.

Extensive Network

Over the years, we have built strong relationships with industry professionals, including real estate agents, developers, mortgage brokers, and legal experts.

Support Throughout the Buying Process

From property inspections to contract negotiations, we provide ongoing support at every stage of the buying process. Our team is dedicated to ensuring a smooth and stress-free experience for you. We liaise with all relevant parties, including real estate agents, solicitors, and building inspectors, to ensure that everything is in order and deadlines are met.

- Focus on Your Best Interests

- Transparent and Ethical Practices

- Property Inspections

- Assessing Market Value

- Contract Negotiations

Focus on Your Best Interests

At SM Sydney Real Estate, your best interests are our top priority. As independent buyers advocates, we have a fiduciary duty to act solely in your favor. We are not influenced by any conflicts of interest, such as commissions from sellers or developers. Our goal is to secure the right property at the right price, ensuring that your investment aligns with your long-term goals.

Latest Blogs

Choosing a Buyers Agent for Your Dream Home or Investment Property (Ultimate Guide)

Behind the Scenes: A Day in the Life of a Buyers Agent, Sydney

Adelaide Property Trends: Insights from a Buyers Agent

Testimonials

Checkout what our clients say about us!

Emma P.

I cannot express enough gratitude to SM Sydney Real Estate for their outstanding service. As a first-time homebuyer, I was overwhelmed by the complexities of the Sydney property market. However, their team provided invaluable guidance, conducted thorough research, and negotiated on my behalf. Thanks to their expertise, I found my dream home within my budget. Their professionalism, transparency, and dedication exceeded my expectations. I highly recommend SM Sydney Real Estate to anyone looking for a reliable and trustworthy buyers advocacy service.

Mark D.

I had been searching for the perfect investment property in Sydney for months, but nothing seemed to meet my criteria. Then I came across SM Sydney Real Estate, and it was a game-changer. Their team not only understood my investment goals but also had access to off-market opportunities. Their extensive network and market knowledge helped me secure a fantastic property that I wouldn’t have found on my own. Working with them was seamless, and their attention to detail and commitment to my best interests were evident throughout the process. I highly recommend SM Sydney Real Estate for anyone seeking expert buyers advocacy.

Sarah T.

SM Sydney Real Estate made the daunting task of buying a property in Sydney a breeze. From our first consultation to the final settlement, their team provided exceptional support, valuable insights, and expert guidance. They took the time to understand my preferences and diligently searched for properties that matched my requirements. Their negotiation skills were outstanding, and they managed to secure my dream home at a great price. The level of professionalism, integrity, and personalized service they offered was exceptional. I am incredibly grateful to SM Sydney Real Estate and highly recommend their services to anyone in need of buyers advocacy.

Don't Know What To Start With?

Get A Solutions For All Roofing Services

Take the first step towards a successful property purchase by contacting us today. Let our expertise, industry knowledge, and dedication work for you. Discover the benefits of having a knowledgeable advocate by your side, guiding you towards the best property opportunities in Sydney. Welcome to SM Sydney Real Estate, where your property dreams become a reality.